MIRAE ASSET

ARBITRAGE FUND - (MAAF) $

(An open ended scheme investing in arbitrage opportunities)

| Type of Scheme | An open ended scheme investing in arbitrage opportunities |

| Investment Objective | The investment objective of the scheme is to generate capital appreciation and income by predominantly investing in arbitrage opportunities in the cash and derivative segments of the equity markets and the arbitrage opportunities available within the derivative segment and by investing the balance in debt and money market instruments. There is no assurance or guarantee that the investment objective of the scheme will be realized. |

Fund Manager** |

Mr. Jignesh Rao Equity portion(since 19 June 2020), Mr. Jigar Sethia Equity portion(since 19 June 2020) & Mr. Mahendra Jajoo Debt portion (since 19 June 2020) |

| Allotment Date | 19 June, 2020 |

| Benchmark Index | NIFTY 50 Arbitrage Index |

| Minimum Investment Amount |

₹ 5,000/- and inmultiples of ₹ 1/- thereafter Minimum Additional Application Amount: ₹ 1,000/- per application and inmultiples of ₹ 1/- thereafter. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

Monthly and Quarterly: ₹ 1,000/- (multiples of ₹ 1/- thereafter), minimum 5 installments |

| Load Structure | Entry load: NA Exit Load: 0.25% if redeemed or switched out within 30 days from the date of allotment Nil after 30 days |

| Plans Available | Regular Plan and Direct Plan |

| Options Available | Growth Option and Dividend Option (Payout & Re-investment) |

| Monthly Average AUM (₹ Cr.) as on August 31, 2020 | 232.70 |

| Net AUM (₹ Cr.) |

237.24 |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on August 31, 2020 |

Regular Plan: 1.05% Direct Plan: 0.42% |

| ANY DATE SIP provides one of the better investment experiences by allowing the investor to choose any investment date of the month (i.e., from 1st to 28th) depending upon the investors' expense and income flow. | |

| **For experience of Fund Managers Click Here | |

| NAV: | Direct Plan | Regular Plan |

| Growth Option | ₹ 10.063 | ₹ 10.049 |

| Dividend Option | ₹ 10.063 | ₹ 10.049 |

| New Position Bought |

| Stock |

| Cement |

| Grasim Industries Limited |

| Finance |

| HDFC Life Insurance Company Limited |

| Consumer Non Durables |

| Hindustan Unilever Limited |

| Consumer Non Durables |

| ITC Limited |

| Pharmaceuticals |

| Lupin Limited |

| Gas |

| Petronet LNG Limited |

| Chemicals |

| Tata Chemicals Limited |

| Software |

| Tata Consultancy Services Limited |

| Ferrous Metals |

| Tata Steel Limited |

| Positions Exited |

| Stock |

| Non - Ferrous Metals |

| Hindalco Industries Limited |

| Ferrous Metals |

| JSW Steel Limited |

| Auto |

| Maruti Suzuki India Limited |

| Finance |

| Muthoot Finance Limited |

| Consumer Durables |

| Titan Company Limited |

| Non - Ferrous Metals |

| Vedanta Limited |

| Positions Increased |

| Finance |

| Housing Development Finance Corporation Limited |

| SBI Life Insurance Company Limited |

| Industrial Products |

| SRF Limited |

| Petroleum Products |

| Reliance Industries Limited |

| Software |

| Infosys Limited |

| Telecom - Services |

| Bharti Airtel Limited |

| Positions Decreased |

| Auto |

| Ashok Leyland Limited |

| Banks |

| Axis Bank Limited |

| State Bank of India |

| The Federal Bank Limited |

| Consumer Non Durables |

| Tata Consumer Products Limited |

| Finance |

| Power Finance Corporation Limited |

| Non - Ferrous Metals |

| National Aluminium Company Limited |

| Petroleum Products |

| Bharat Petroleum Corporation Limited |

| Transportation |

| Adani Ports and Special Economic Zone Limited |

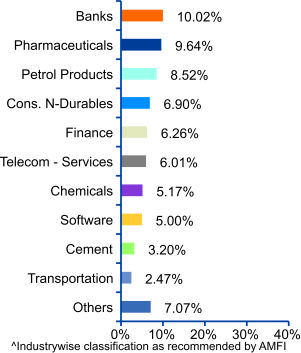

| Portfolio Holdings | % Allocation |

| Banks | |

| ICICI Bank Ltd | 3.43% |

| State Bank of India | 3.38% |

| IndusInd Bank Ltd | 1.34% |

| Axis Bank Ltd | 1.16% |

| The Federal Bank Ltd | 0.71% |

| Pharmaceuticals | |

| Sun Pharmaceutical Industries Ltd | 3.07% |

| Lupin Ltd | 2.49% |

| Aurobindo Pharma Ltd | 1.82% |

| Divi's Laboratories Ltd | 1.53% |

| Biocon Ltd | 0.73% |

| Petroleum Products | |

| Reliance Industries Ltd* | 4.43% |

| Hindustan Petroleum Corporation Ltd | 1.97% |

| Indian Oil Corporation Ltd | 1.90% |

| Bharat Petroleum Corporation Ltd | 0.22% |

| Consumer Non Durables | |

| Colgate Palmolive (India) Ltd | 3.02% |

| Dabur India Ltd | 2.03% |

| Tata Consumer Products Ltd | 0.79% |

| ITC Ltd | 0.75% |

| Godrej Consumer Products Ltd | 0.16% |

| Hindustan Unilever Ltd | 0.16% |

| Finance | |

| Housing Development Finance Corporation Ltd | 3.01% |

| SBI Life Insurance Company Ltd | 1.86% |

| Power Finance Corporation Ltd | 0.96% |

| HDFC Life Insurance Company Ltd | 0.43% |

| Telecom - Services | |

| Bharti Airtel Ltd | 6.01% |

| Chemicals | |

| Tata Chemicals Ltd | 2.95% |

| Pidilite Industries Ltd | 2.22% |

| Software | |

| Infosys Ltd | 3.57% |

| Tata Consultancy Services Ltd | 1.43% |

| Cement | |

| Grasim Industries Ltd | 2.22% |

| Ambuja Cements Ltd | 0.99% |

| Transportation | |

| Adani Ports and Special Economic Zone Ltd | 2.47% |

| Media & Entertainment | |

| Sun TV Network Ltd | 2.12% |

| Ferrous Metals | |

| Tata Steel Ltd | 1.48% |

| Non - Ferrous Metals | |

| National Aluminium Company Ltd | 1.31% |

| Industrial Products | |

| SRF Ltd | 1.24% |

| Gas | |

| Petronet LNG Ltd | 0.43% |

| Power | |

| NTPC Ltd | 0.39% |

| Auto | |

| Ashok Leyland Ltd | 0.10% |

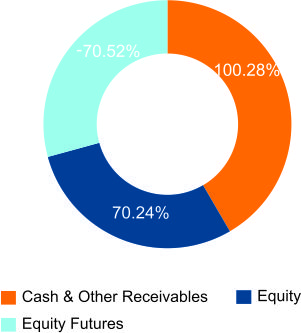

| Equity Holding Total | 70.24% |

| Equity Futures | |

| Ashok Leyland Ltd | -0.10% |

| Hindustan Unilever Ltd | -0.16% |

| Godrej Consumer Products Ltd | -0.17% |

| Bharat Petroleum Corporation Ltd | -0.22% |

| NTPC Ltd | -0.40% |

| Petronet LNG Ltd | -0.43% |

| HDFC Life Insurance Company Ltd | -0.43% |

| The Federal Bank Ltd | -0.72% |

| Biocon Ltd | -0.73% |

| ITC Ltd | -0.75% |

| Tata Consumer Products Ltd | -0.79% |

| Power Finance Corporation Ltd | -0.97% |

| Ambuja Cements Ltd | -0.99% |

| Axis Bank Ltd | -1.16% |

| SRF Ltd | -1.25% |

| National Aluminium Company Ltd | -1.31% |

| IndusInd Bank Ltd | -1.34% |

| Tata Consultancy Services Ltd | -1.43% |

| Tata Steel Ltd | -1.49% |

| Divi's Laboratories Ltd | -1.53% |

| Aurobindo Pharma Ltd | -1.82% |

| SBI Life Insurance Company Ltd | -1.86% |

| Indian Oil Corporation Ltd | -1.91% |

| Hindustan Petroleum Corporation Ltd | -1.98% |

| Dabur India Ltd | -2.04% |

| Sun TV Network Ltd | -2.13% |

| Grasim Industries Ltd | -2.23% |

| Pidilite Industries Ltd | -2.23% |

| Adani Ports and Special Economic Zone Ltd | -2.48% |

| Lupin Ltd | -2.51% |

| Tata Chemicals Ltd | -2.97% |

| Colgate Palmolive (India) Ltd | -3.02% |

| Housing Development Finance Corporation Ltd | -3.02% |

| Sun Pharmaceutical Industries Ltd | -3.07% |

| State Bank of India | -3.39% |

| ICICI Bank Ltd | -3.44% |

| Infosys Ltd | -3.58% |

| Reliance Industries Ltd* | -4.45% |

| Bharti Airtel Ltd | -6.04% |

| Equity Futures Total | -70.52% |

| Cash & Other Receivables | 100.28% |

| Total | 100.00% |

*Includes "Partly Paid Shares"

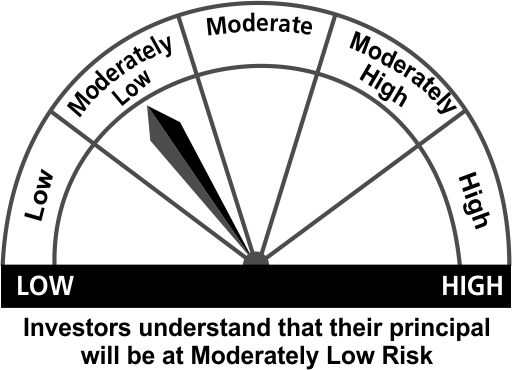

This product is suitable for investors who are seeking*

• Income over short term

• Investments predominantly in arbitrage opportunities in the cash and derivative segments and the arbitrage opportunities available within the derivative segment

• Degree of risk - MODERATELY LOW

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : Since the scheme is in existence for less than 1 year, as per SEBI regulation performance of the scheme has not been shown.The performance of other funds managed by the same fund managers are given in the respective page of the schemes